Deposit Money into Alertpay Account in Pakistan

We all goes through a recession period in which many people are jobless and want to earn money. One of the new and emerging way is to earn through online and many people are moving towards this way. But earning money online is not that easy that it looks like. Since Paypal not supported Pakistan we have to rely on other payment processors like Alertpay which in the end reduces earning options for Pakistanis. Many of the earning options left for Pakistanis are required you to first deposit money or open an account with money. So you need first to upload money to your payment processor like Alertpay.

We all goes through a recession period in which many people are jobless and want to earn money. One of the new and emerging way is to earn through online and many people are moving towards this way. But earning money online is not that easy that it looks like. Since Paypal not supported Pakistan we have to rely on other payment processors like Alertpay which in the end reduces earning options for Pakistanis. Many of the earning options left for Pakistanis are required you to first deposit money or open an account with money. So you need first to upload money to your payment processor like Alertpay.So how to deposit money into your alertpay account. Well bad news is that alertpay not support bank transfer in Pakistan which is the most reliable and cost effective way. So we left with Money order, by check or by wire transfer. Lets discuss all these methods.

1. Money Order:

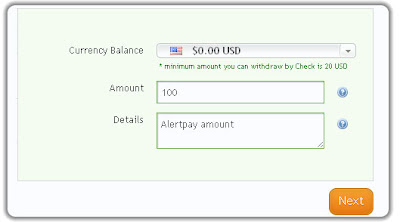

One way to send money to your alertpay account is through money order. For this login into your alertpay account then click on Deposit Tab and then select Money Order. Fill in the amount you want to send and click next, confirm on next page and at the last page it will show you the message like this.

Step 1: Go to your local bank or financial institution

Step 1: Go to your local bank or financial institution

Step 2: Request to send a money order in the amount of $100.00 USD.

Step 3: Send certified check to:

AlertPay Inc.

Processing Department

8255 Mountain Sights, suite 100

Montreal QC H4P 2B5

Canada

Processing Department

8255 Mountain Sights, suite 100

Montreal QC H4P 2B5

Canada

Please include the reference number along with your money order to avoid unnecessary delays in processing your transaction. The process time for this type of transaction is 1-2 business days. The best thing about this option is that its processing fee is Nil. Money Orders must be in USD currency.

2. Check:

The second option is by check. The process is the same as for money order. For this login into your alertpay account then click on Deposit Tab and then select by check. Fill in the amount you want to send and click next, confirm on next page and at the last page it will show you the message like this.

The second option is by check. The process is the same as for money order. For this login into your alertpay account then click on Deposit Tab and then select by check. Fill in the amount you want to send and click next, confirm on next page and at the last page it will show you the message like this.Step 1: Go to your local bank or financial institution

Step 2: Request to send a money order in the amount of $100.00 USD.

Step 3: Send certified check to:

AlertPay Inc.

Processing Department

8255 Mountain Sights, suite 100

Montreal QC H4P 2B5

Canada

Processing Department

8255 Mountain Sights, suite 100

Montreal QC H4P 2B5

Canada

Please include the reference number along with your money order to avoid unnecessary delays in processing your transaction. The process time for this type of transaction is 1-2 business days. The best thing about this option is that it has no processing fee. Checks must be in USD Currency.

3. Bank Wire:

The third and last option is through Bank wire. For this login into your alertpay account then click on Deposit Tab and then select Bank Wire. Fill in the amount you want to send and click Deposit, confirm on next page and at the last page it will show you the message like this.

Step 1: Go to your local bank or financial institution

Step 2: Request to send a bank wire in the amount of$100.00 USD

Step 3: Send bank Wire to:

Bank Details

Company Name: Jameson Bank/AlertPay

Company Address: 200 Front St. West

Toronto, ON, Canada, M5V 3K2

Company Name: Jameson Bank/AlertPay

Company Address: 200 Front St. West

Toronto, ON, Canada, M5V 3K2

Bank Address

Bank Name: Deutsche Bank Trust Company Americas

Bank Address: lahore

Bank City, State, Zip: pakistan

SWIFT Code: BKTRUS33

Routing/ABA Number: 02100266

Account Number: 0018777

Bank Name: Deutsche Bank Trust Company Americas

Bank Address: lahore

Bank City, State, Zip: pakistan

SWIFT Code: BKTRUS33

Routing/ABA Number: 02100266

Account Number: 0018777

Please include the AlertPay Ref# along with your bank wire transaction to avoid unnecessary delays in processing your transaction. Bank wires must be in USD currency. Minimum amount you can deposit is $40.00 USD. Transaction fee for this is $20.00 USD. Processing time for bank wire is 2 business days upon receipt. Transaction expires if funds not received within 7 days

We all in Pakistan pray daily that

We all in Pakistan pray daily that